Check National Insurance And Tax

National Insurance is paid into a specific pot of tax money called the National Insurance Fund which was established in 1948 to provide health insurance unemployment benefits pensions and other benefits to post-war Britons. The amount of wage taxnational insurance contributions you must withhold is based on the bracket rate for the wage taxnational insurance contributions.

Calculators Calculators National Insurance Tax

This calculator assumes youre employed as self-employed national insurance rates are different.

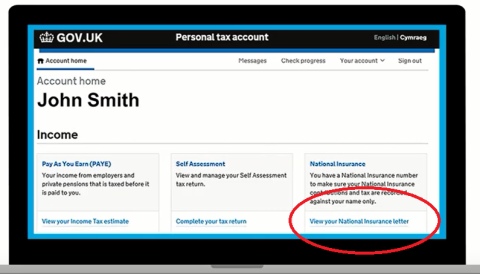

Check national insurance and tax. What National Insurance credits you received NI credits only show where applicable. This letter should include which tax years you are applying for the reason for your refund request and your National Insurance number. You can call HMRC on 0300 200 3500.

NI contributions paid up to the beginning of the most current tax year ie. Any errors on your P60 may mean you are due a tax rebate or have to repay additional tax. Whether there are any gaps in contributions or credits.

National Insurance is a tax on earnings and self-employed profits. National Insurance Contributions payment made. If youre self-employed and you have a personal tax account you can login to your account and see your National Insurance number there.

National Insurance NI is a state tax on your earnings. The National Insurance rate you pay depends on how much you earn. Your payslip will show your contributions.

12 of your weekly earnings between 184 and 967 2021-22 2 of your weekly earnings above 967. Use the National Insurance record checker to view results of. It can help work out your take-home pay if you dont have any other deductions for example pension contributions or student loans.

If you use your National Insurance number to help confirm your UK residence in your application we carry out an automated check of UK tax and some benefits records to. You can find your National Insurance number on your payslip P60 or letters about tax benefits or pensions. If youre in the UK call 0300 200 3500.

National Insurance Contributions and Employer Office. National Insurance is a form of tax on earnings which impacts all workers who have to pay once they earn over a certain threshold amount. Calculating wage taxnational insurance contributions.

In 2020 there will be 2 bands. This record is important when claiming certain welfare. You can use GOVuks tool to estimate how much Income Tax and National Insurance you should pay for the current tax year.

You pay National Insurance with your tax. This is only a ready reckoner that makes standard assumptions to estimate your tax breakdown. The Check your National Insurance record tool enables users to see what theyve paid up to the start of the current tax year - meaning April 6 2020.

Check the spellings are correct. What youve paid up to the start of the current tax year 6 April 2021 any National Insurance credits youve received if gaps in. Your National Insurance contributions are paid into a fund from which some state benefits are paid.

A first band with a salary to 68507 and a second bad with a salary of 68508 or more. Lines are open Monday to Friday 8am to 8pm and Saturday 8am to 4pm. Check the following areas of your P60 are correct.

The service also details any National. 6 years from the tax year in question. Ensure the National Insurance Number shown is your National Insurance Number.

Your National Insurance contributions will be taken off along with Income Tax before your employer pays your wages. This includes the state pension statutory sick pay or maternity leave or entitlement to additional unemployment benefits. If youre outside the UK call 44 191 203 7010.

If youre a director of a limited company you. If you cant fill out the form or if you never received confirmation of your National Insurance number in the post you can call the National Insurance number helpline. HM Revenue Customs Department for Work and Pensions HM Treasury Ministry of Defence and Office for Veterans Affairs.

There are many other possible variables for a definitive source check your tax code and speak to the tax office. National Insurance - your National Insurance number how much you pay National Insurance rates and classes check your contributions record. Your employer will take it from your wages before you get paid.

Find out how it works how much youll pay and what youre entitled to when you make NI contributions. You can check your National Insurance record online to see.

Check How Much Hmrc Income Tax You Paid Income Tax Return Income Tax Tax Return

Blue P60 Payslips National Insurance Number Tax Rebates Online

Get Original Payslips For Your Employ At Each Additional 4 National Insurance Number Company Names Year Of Dates

Important Things In Your Payslips Need To Check In 2021 National Insurance Number Payroll Template Payroll Software

Freelancer Received Their First Payslips To Aid In Pay Transparency In The Uk About Uk National Insurance Number Extra Money

Get Order Your Replacement Or P60 Documents Within The Same Day Of Order And That Was Prepared By Payroll Exp National Insurance Number Online Company Names

Order Replacement P60 Uk Online National Insurance Number Replacement

How To Get A National Insurance Card 9 Steps With Pictures

If You Have Lost Your Payslips Or Need Replacement Wage Slips Online Then Payslips Online Is The Perfect National Insurance Number Payroll Template Unit Rate

Income Tax Form Hmrc Why You Should Not Go To Income Tax Form Hmrc Tax Forms Income Tax Tax

How To Find Your National Insurance Number Nino Low Incomes Tax Reform Group

Post a Comment for "Check National Insurance And Tax"