Life Insurance Meaning And Importance

If during the term of the policy the life insured dies the policy promises to pay a death benefit. What is the meaning of life insurance and what is its importance.

Life Insurance May Be One Of The Most Important Purchases You Ll Ever Make If Someone Depends O Life Insurance Quotes Life Insurance Marketing Ideas Insurance

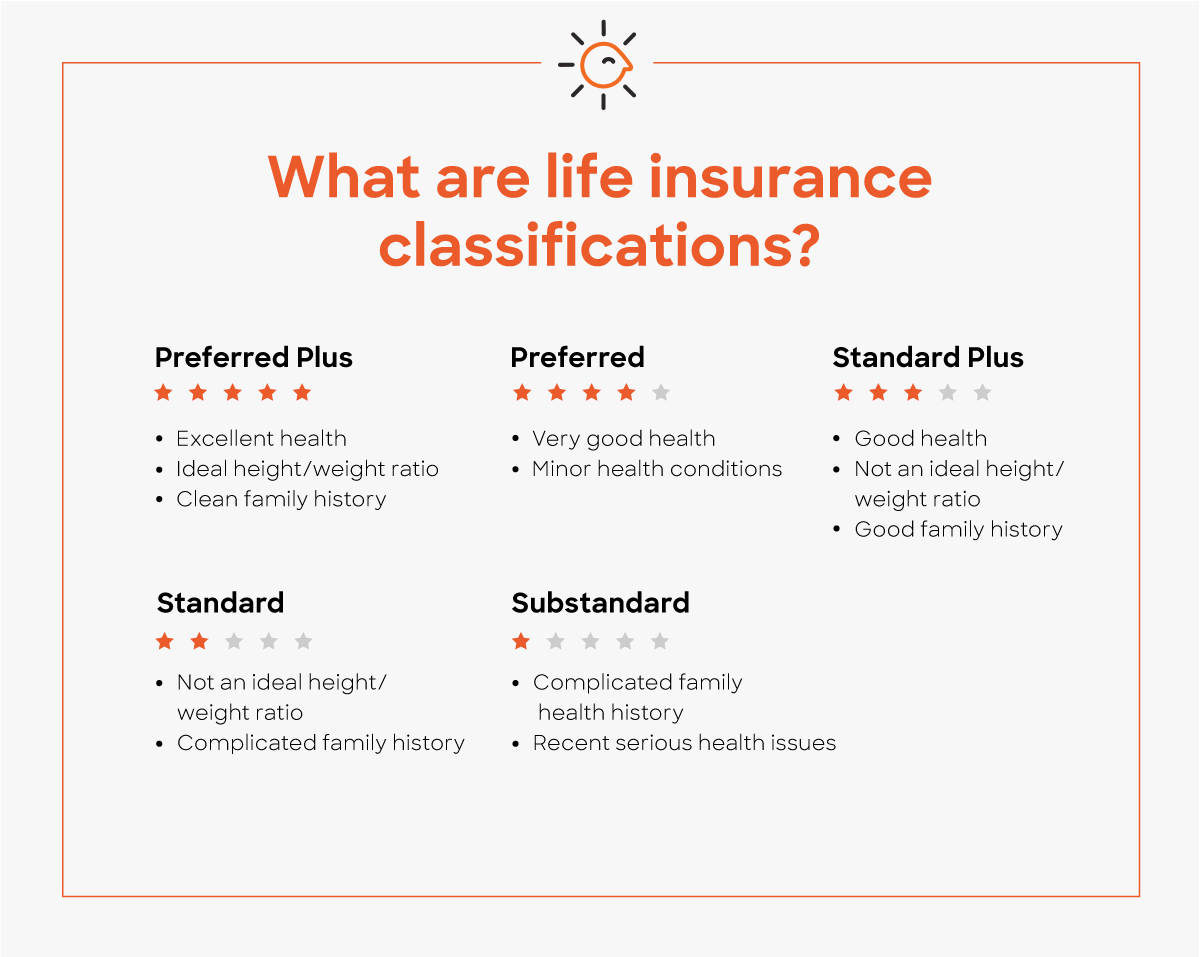

Listed below are some important differences between different types of life insurance policies and what they mean for you.

Life insurance meaning and importance. Business efficiency is increasing with insurance. Meaning pronunciation translations and examples. The Importance of Life Insurance Alliance Group and Life Insurance Awareness.

If youre married and have kids this can matter a lot especially if youre the primary breadwinner. Importance of Insurance to Business. Life insurance is a form of protection from financial loss that grants your beneficiaries cash benefits in the event of your death.

Life Insurance Meaning and Importance. Permanent life insurance means that you and your loved ones are covered for an undetermined length of time and the benefits are guaranteed no matter how long you live until. If mn gt hurt at your office th insurance will cover n costs th incur to get treatment.

Besides social security is provided to workers through the Employees State InsuranceESI scheme whereby accidental risks are covered. IMPORTANCE OF LIFE INSURANCE IN OUR LIFE Life Insurance A life insurance policy is a contract with an insurance company. A life insurance policy is a type of insurance cover that provides monetary benefit to the family of the insured in case of hishers unfortunate demise.

Life insurance is a contract between an insurance policy holder and the insurance provider known as the insurer that guarantees to pay the designated amount to the beneficiary in case of the death of the insured person. Apart from being an important source of saving tax premiums paid towards a life insurance plan are eligible for tax deduction under Section 80C of the Income Tax. Life insurance is a policy which covers the risk of premature death.

In exchange for premium payments the insurance company provides a lump-sum payment known as a death benefit to beneficiaries upon the insureds death. One of the primary reasons people get life insurance is to help ensure their loved ones wont face financial hardships if they pass away unexpectedly. Also provides peace of mind.

The premiums for permanent life insurance are much higher than term insurance for many reasons. Insurance provides safety and security. Life insurance policies are legal contracts where against the coverage offered by the insurance company you are supposed to pay a premium for availing the coverage.

Life-insurance encourages saving and. The life insurance sum is paid in exchange for a specific amount of premium. The benefits of insurance are discussed below.

If one goes by the word meaning insurance is a contract between two parties whereby the insurer agrees to indemnify the insured upon the happening of a stipulated contingency in consideration of the payment of an agreed sum whether periodical or fixed the premium. Typically life insurance is chosen according to the need and demand of. Life Insurance is defined as a contract between the policy holder and the insurance company where the life insurance company pays a specific sum to the insured individuals family upon his death.

It wll l cover property damage covering the expense of repairs if a patients property damaged at your office. Importance of Insurance to Individuals. Life insurance provides profitable investment.

Life Insurance Meaning And Importance May 2021. Why is life insurance so important. Life insurance is a form of insurance in which a person makes regular payments to an.

The policy is bought from an insurance company which will pay a fixed sum of money either at the expiry of a fixed tenure or to compensate the family on the death of the insured. Importance of Life Insurance. Life Auto Home Health Business Renter Disability Commercial Auto Long Term Care Annuity.

Life insurance is a form of protection from financial loss that grants your beneficiaries cash benefits in the event of your death. Protects the mortgaged property. Life insurance definition.

Life insurance provides security against risks of old age and premature death of people. Life insurance is the protection of a family against loss of income in case of the death of the person insured.

What Is Life Insurance Exact Definition Meaning Of Life Insurance

Insured Ka Na Ba Start Protecting Your Future Today To Schedule Free Consultation Personal Financial Planning Life Insurance Marketing Insurance Marketing

Advantages And Disadvantages Of Life Insurance Policy Life Insurance Policy Insurance Policy Life Insurance

Pin On Policy Architects Life Insurance Tips Tricks

Financial Planning Why It Is Important Via Secure247trade Financial Wellness Emergency Savings Financial Planning

What Is Life Insurance Exact Definition Meaning Of Life Insurance

Insurance Defination Importance Types And Benifets What Is Health Life Insurance Policy Insurance

Understanding The Life Insurance Medical Exam Policygenius

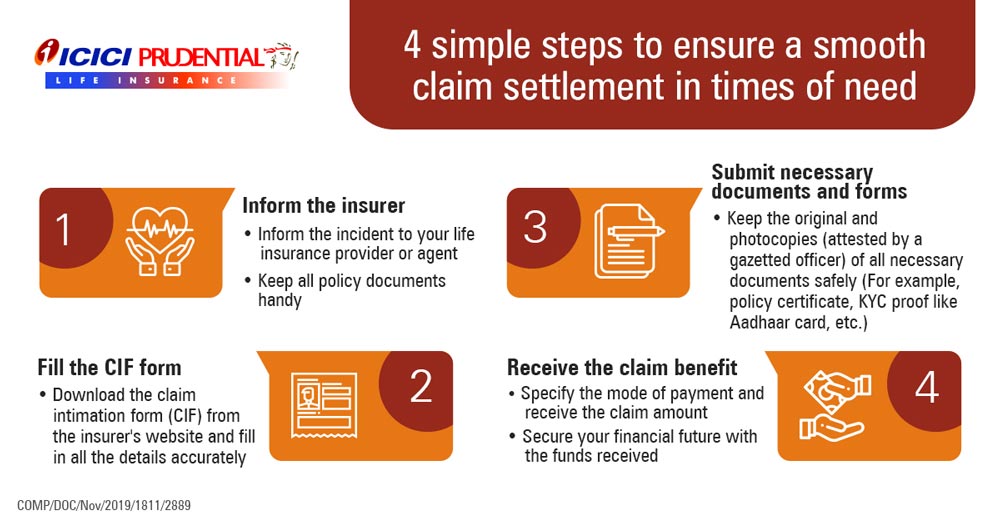

What Is Life Insurance Life Insurance Definition Meaning Icici Prulife

What Is Life Insurance Exact Definition Meaning Of Life Insurance

Features Of Life Insurance Contract Mba Knowledge Base

How Much Life Insurance Do You Need Answer A Few Simple Questions To Find Out Business Insurance Life Insurance Financial Wellness

Difference Between Term Life Insurance Insurance Industry Insurance Broker

Class Xi Business Study Life Insurance Meaning Objectives Principles A Studying Life Business Studies Life Insurance Policy

Whole Life Insurance Is Also Known As Permanent Insurance Being The Insured Person It Is Intended To Whole Life Insurance Life Insurance Insurance Policy

Post a Comment for "Life Insurance Meaning And Importance"